Oil and Gas and Chemical businesses who have more than one site often have various Risk Based Inspection (RBI) methodologies in their portfolio. Typically this derives from mergers and acquisitions, risk models changing overtime, different RBI software packages, or various different global regulatory drives (API 580/581 vs. European Risk Management Associations RIMAP standards).

Different RBI methodologies will typically dictate different data models, work processes, and reporting metrics. This doubles or triples your man power to understand your current risk state, analysis and reporting, training, and IT costs.

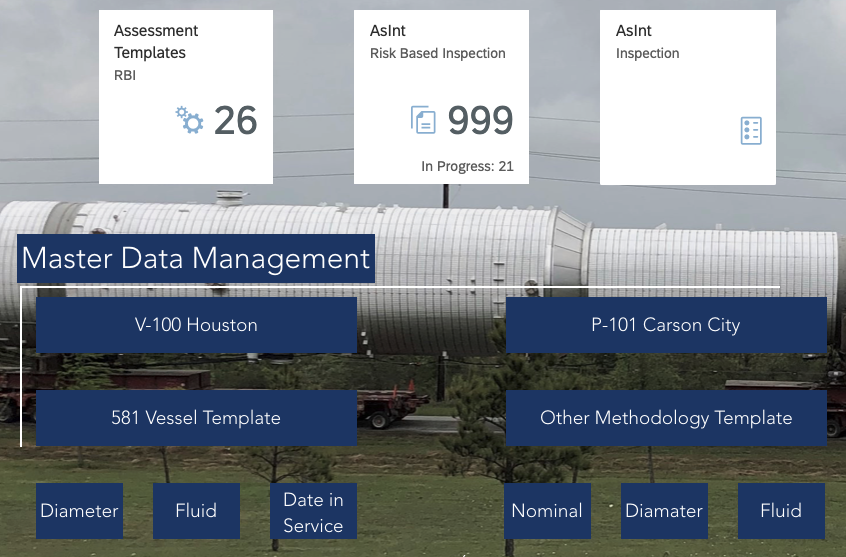

The SAP Asset Intelligence Network (AIN) solution set offers an extended template driven modeling capability that allows operators to setup multiple data sets to describe the various RBI approaches. This, combined with the AsInt RBI App embedded within the SAP AIN and ASPM (Asset Strategy and Performance Management) allows operators to manage multiple RBI approaches within a single solution.

When moving to a different software platform, whether it be a MS Excel model or a commercial off-the-shelf, it can be disruptive to work process, costs, and often internal political barriers arise blocking progress to move forward. This Use Case approach allows for a single solution set while removing hurdles. Whether the operator wants to manage multiple RBI modules, or gradually move to a consolidated methodology overtime, the solution allows for a single set of data to execute RBI metrics and consolidate work processes (security, workflow, data import, etc).

At AsInt, our philosophy and software allows users to choose what RBI (Risk Based Inspection) you would like to use. The “templatized” approach allows for scaling and adapting to fully qualitative to full quantitative.

Some of the models, or templates, we have deployed to customer tenants include:

A Higher Form of

Asset Intelligence

AsInt brings a fresh take on the design of mechanical integrity and reliability software with faster, more intuitive functionality for the multi-device generation.

© Copyright 2024, All Rights Reserved by AsInt, Inc.